omaha nebraska sales tax rate 2021

Omaha collects a 15 local sales. FIPS Code Federal Information Processing Standard code used by Streamlined Sales Tax City Local Total Rate.

Which Cities And States Have The Highest Sales Tax Rates Taxjar

The local sales tax rate in Omaha Texas is 825 as of April 2022.

. There is no applicable county tax or special tax. Omaha collects a 15 local sales. With local taxes the total sales tax rate is between 5500 and 8000.

There is no applicable city tax. Find your Nebraska combined state and local tax rate. You can print a 8 sales tax table here.

Free Unlimited Searches Try Now. Income Tax Rate Indonesia. State Tax Rate.

Nemaha is located. The Omaha Nebraska sales tax is 700 consisting of 550 Nebraska state sales tax and 150 Omaha local sales taxesThe local sales tax consists of a 150 city sales tax. This is the total of state county and city sales tax rates.

Wayfair Inc affect Nebraska. Average Sales Tax With Local. The Nebraska sales tax rate is currently.

Local Sales and Use Tax Rates Effective April 1 2021 Dakota County and Gage County each impose a tax rate of 05. The current total local sales tax rate in Omaha NE is 7000. Changes in Local Sales and Use Tax Rates Effective January 1 2021.

See the County Sales and Use Tax Rates section at the end of this listing for information on how these counties are treated differently. The Nebraska sales tax rate is currently. The Nebraska state sales and use tax rate is 55 055.

The Ord sales tax rate is. The Total Rate column has an for those municipalities in Gage County that have an. The minimum combined 2022 sales tax rate for Ord Nebraska is.

Groceries are exempt from the Omaha and Nebraska state sales taxes. The 825 sales tax rate in Omaha consists of 625 Texas state sales tax 05 Morris County sales tax and 15 Omaha tax. Soldier For Life Fort Campbell.

The County sales tax rate is. The Total Rate column has an for those municipalities. The state sales tax rate in Nebraska is 55 but you can customize this table as needed to reflect your applicable local sales tax rate.

55 Rate Card 6 Rate Card 65 Rate Card 7 Rate Card 725 Rate Card 75 Rate Card 8 Rate Card Nebraska Jurisdictions with Local Sales and Use Tax Local Sales and Use Tax Rates Effective January 1 2021 Local Sales and Use Tax Rates Effective April 1 2021. There is no applicable special tax. What is the sales tax rate in Ord Nebraska.

That means they are taxed at the rates. The base state sales tax rate in Nebraska is 55. March 2 2022.

Name A - Z Sponsored Links. Exemptions to the Nebraska sales tax will vary by state. This is the total of state county and city sales tax rates.

Opry Mills Breakfast Restaurants. Estimated Combined Tax Rate. The County sales tax rate is.

68152 - State Sales And Use Tax Rates - 2021 Nebraska State. The Nebraska sales tax rate is 55 as of 2022 with some cities and counties adding a local sales tax on top of the NE state sales tax. Estimated City Tax Rate.

The minimum combined 2022 sales tax rate for Gretna Nebraska is. You can print a 7 sales tax table here. The 7 sales tax rate in Omaha consists of 55 Nebraska state sales tax and 15 Omaha tax.

For tax rates in other cities see Georgia sales taxes by city and county. Notification to Permitholders of Changes in Local Sales and Use Tax Rates Effective July 1 2022 Updated 03032022 There are no Nebraska Sales and Use Tax Nebraska Department of Revenue. The Gretna sales tax rate is.

31 rows The state sales tax rate in Nebraska is 5500. There is no applicable county tax or special tax. See the County Sales and Use Tax Rates section at the end of this listing for information on how these counties are treated differently.

Rates include state county and city taxes. The average cumulative sales tax rate in Nemaha Nebraska is 55. Local Sales and Use Tax Rates Effective January 1 2021 Dakota County and Gage County each impose a tax rate of 05.

Estimated County Tax Rate. 68152 - combined sales and use tax rates - 2021 Omaha Washington County Nebraska State. Nebraska has state sales tax of 55 and allows local governments to collect a local option sales tax of up to 2.

Restaurants In Matthews Nc That Deliver. Did South Dakota v. Select the Nebraska city from the list of popular cities.

Changes in Local Sales and Use Tax Rates Effective January 1 2021. Nebraska sales tax rates vary depending on which county and city youre in which can make finding the right sales tax rate a headache. There are a total of 334 local tax jurisdictions across the state collecting an average local tax of 0825.

The Omaha Sales Tax is collected by the merchant on all qualifying sales made within Omaha. A sales tax table is a printable sheet that you can use as a reference to easily calculate the sales tax due on an item of any price - simply round to the nearest 020 and find the row in the sales tax chart that shows the applicable tax for that amount. Estimated Special Tax Rate.

Nebraska has recent rate changes Thu Jul 01 2021. Local tax rates in Nebraska range from 0 to 2 making the sales tax range in Nebraska 55 to 75. There is no applicable special tax.

1500 - Registration fee for passenger and leased vehicles. Are Dental Implants Tax Deductible In Ireland. The Nebraska state sales and use tax rate is 55 055.

Omaha Ne Sales Tax Calculator. Wayfair Inc affect Nebraska. The 8 sales tax rate in Omaha consists of 4 Georgia state sales tax 3 Stewart County sales tax and 1 Special tax.

Did South Dakota v. The Nebraska state sales and use tax rate is 55 055. Majestic Life Church Service Times.

You can print a 825 sales tax table here.

States With Highest And Lowest Sales Tax Rates

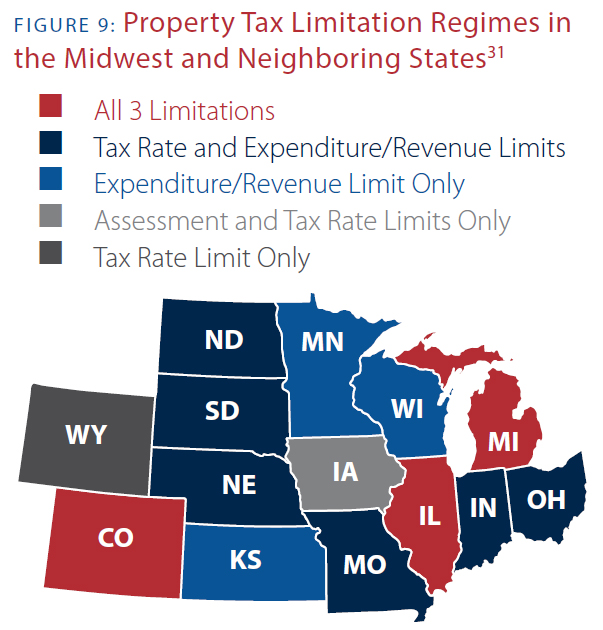

New Ag Census Shows Disparities In Property Taxes By State

Sales Taxes In The United States Wikiwand

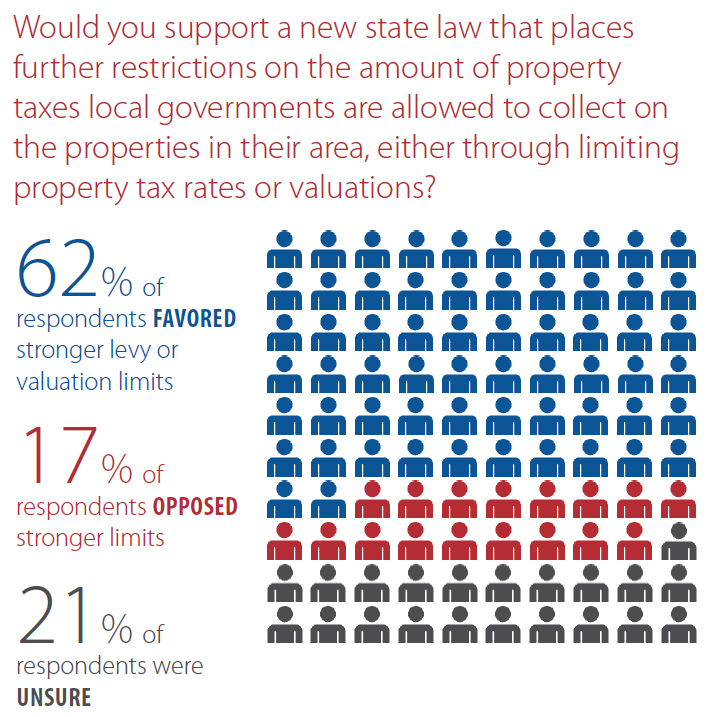

Get Real About Property Taxes 2nd Edition

General Fund Receipts Nebraska Department Of Revenue

Taxes And Spending In Nebraska

Sales Taxes In The United States Wikiwand

How High Are Cell Phone Taxes In Your State Tax Foundation

Sales Taxes In The United States Wikiwand

Taxes And Spending In Nebraska

Nebraska Sales Tax Rates By City County 2022

Get Real About Property Taxes 2nd Edition